As the trade war

between China and the USA is raging on, opportunities open for the domestic

market and exporters from countries like Brazil.

China

and the USA, the countries with the world’s two biggest economies, are

threatening and implementing huge tariffs on each other’s products in a fight

that many see as the beginning of a trade war. None of both currently seems to

be willing to give in, even the citizens have mixed opinions.

The

trade war was starting to getting fierce, as the USA called duties on imports

of aluminum and steel and the Chinese government decided to respond with some

extra tariffs on more than 100 American products of up to 25%, especially on

agricultural products imported from the USA, including economical very

important commodities like soybean, corn, wheat, beef and sorghum. However, the

final implementation measures and the date has not officially been announced

yet.

The

tariffs on agricultural products are hitting American farmers and the economy

hard, looking at the fact that agricultural exports from the USA to China

represent almost USD20 billion annually for American farmers. After all, the

USA is the world biggest agricultural producer and many farmers making a living

exporting their goods to emerging markets with high demand, like China.

According

to market intelligence firm CCM, adding tariffs up to 25% won't greatly affect

China's total agricultural imports but will be instead good for the domestic

demand for agricultural products, especially in the food and feed production. A

researcher from CCM disclosed, that additional tariffs on sorghum and soybean

imports will help boost domestic corn demand.

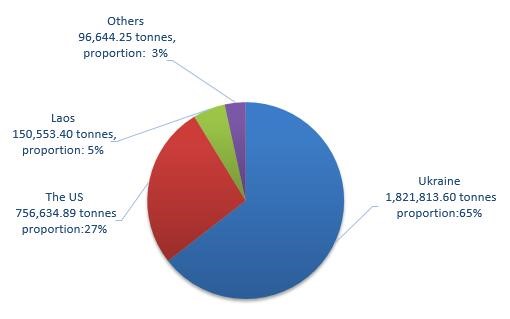

Especially

tariffs on corn will not play a huge role. Official data from China Customs

show that in the whole of 2017, China's corn imports from the USA only took up

27% of its total corn imports. After all, Ukraine is still the most important

corn import origin into China. Therefore, the corn import business won't be

greatly affected by tariff increase on American corn.

Figure

China's selected corn import origins by import volume, 2017

Source:

CCM & China Customs

From

the point of view of the USA, one of the most sensitive issues could be tariffs

on soybean exports. According to CCM’s research, in 2017, soybeans were the

biggest USA agricultural export to China at a value of USD12 to 14 billion.

Hence,

if China is getting serious and slaps the tariff on American soybean, it would

make other global suppliers like Brazil the more attractive choice for Chinese

buyers, who need soybeans as feed for the growing livestock industry.

Furthermore, it is likely that more expensive soybean form the USA would

encourage worldwide suppliers to add more acres of soybeans, and then

negatively impact the price American farmers can get for their crop in return.

China

is the largest consumer of soybeans in the world, using about 60% of the

world’s annual production, to feed its livestock industry, the world’s largest,

including 400 million pigs alone.

To

be more precise, China’s soybean import volume reached 95.54 million tonnes

last year, with 53.31% coming from Brazil, 34.39% from the US and 6.89% from

Argentina. Soybean meal is one of the important raw materials for feed. In

response, feed companies will adjust formula, increasing protein supplements

which contain corn gluten meal, a byproduct of corn processing. Corn gluten

meal contains high protein content and abundant amino acids, which is widely

used to substitute feed raw materials such as soybean meal and fish meal. If

soybean meal prices keep rising, demand for corn gluten meal will rise.

What’s

more, China is the world's largest sorghum importer as well. In 2017, it

imported more than 5 million tonnes of sorghum, of which most of it came from

the USA. As a matter of fact, on February 4, the Mistry of Commerce had

launched anti-dumping and anti-subsidy investigations into sorghum imports from

the USA. For the long run, sorghum import volume will significantly decrease,

and this will boost domestic demand for corn used as feed, according to CCM.

On

the whole, tariff increases on USA soybean and sorghum will boost import prices

of these products from the USA, and will eventually boost domestic demand for

corn, which is good news for the domestic corn market in general.

About the article

The

information for this article comes from CCM, China’s leading market

intelligence provider for the fields of agriculture, chemicals, food and feed.

Take

part in the discussion by joining our groups on LinkedIn and Facebook.

Follow

CCM on Twitter: @CCM_Kcomber